Georgia Tax Calculator

Georgia Income Tax Calculator - SmartAsset

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. ... Georgia Alcohol Tax. Georgia ...

https://smartasset.com/taxes/georgia-tax-calculator

Georgia Tax Calculator: Estimate Your Taxes - Forbes Advisor

Georgia Income Tax Calculator 2021. If you make $70,000 a year living in the region of Georgia, USA, you will be taxed $11,993. Your average tax rate is 11.98% and your marginal tax rate is 22% ...

https://www.forbes.com/advisor/income-tax-calculator/georgia/Georgia Paycheck Calculator - SmartAsset

A financial advisor in Georgia can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.. How You Can Affect Your Georgia Paycheck. If you were slapped with a huge tax bill or received a big lump sum refund ...

https://smartasset.com/taxes/georgia-paycheck-calculator

Georgia State Tax Calculator - Good Calculators

To use our Georgia Salary Tax Calculator, all you have to do is enter the necessary details and click on the "Calculate" button. After a few seconds, you will be provided with a full breakdown of the tax you are paying. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

https://goodcalculators.com/us-salary-tax-calculator/georgia/

Use Ad Valorem Tax Calculator | Georgia.gov

This calculator can estimate the tax due when you buy a vehicle. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. This tax is based on the value of the vehicle. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those ...

https://georgia.gov/use-ad-valorem-tax-calculator

Georgia Sales Tax Calculator - SalesTaxHandbook

You can use our Georgia Sales Tax Calculator to look up sales tax rates in Georgia by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Georgia has a 4% statewide sales tax rate , but also has 470 local tax jurisdictions (including ...

https://www.salestaxhandbook.com/georgia/calculator

Georgia Property Tax Calculator - SmartAsset

There are also a number of property tax exemptions in Georgia that can reduce your home's assessed value and, therefore, your taxes. These vary by county. The statewide exemption is $2,000, but it applies only to the statewide property tax, which is a relatively small slice of the overall property taxes in most areas. Georgia Property Tax Rates

https://smartasset.com/taxes/georgia-property-tax-calculator

Georgia Paycheck Calculator 2022 with Income Tax Brackets

The state income tax rate in Georgia is progressive and ranges from 1% to 5.75% while federal income tax rates range from 10% to 37% depending on your income. This income tax calculator can help estimate your average income tax rate and your take home pay. How many income tax brackets are there in Georgia? The state income tax system in Georgia ...

https://investomatica.com/income-tax-calculator/united-states/georgia

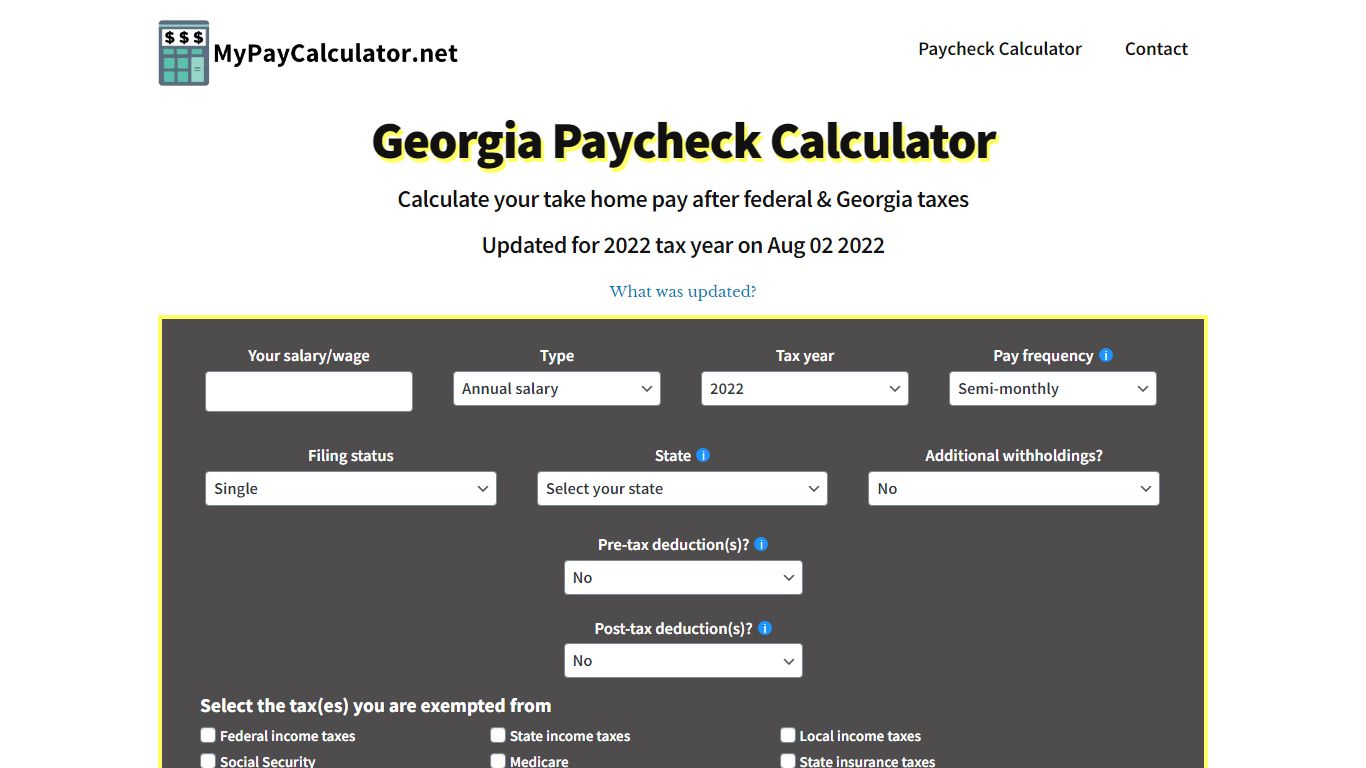

Georgia Paycheck Calculator | Tax year 2022 - MyPayCalculator.net

So the tax year 2022 will start from July 01 2021 to June 30 2022. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator: work out your adjusted gross income [ Total annual income – Adjustments = Adjusted gross income] calculate your taxable income [ Adjusted gross income – (Post-tax ...

https://www.mypaycalculator.net/us-paycheck-calculator/georgia/

Georgia Paycheck Calculator | ADP

Use ADP’s Georgia Paycheck Calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP ...

https://www.adp.com/resources/tools/calculators/states/georgia-salary-paycheck-calculator.aspx

Vehicle Taxes–Title Ad Valorem Tax (TAVT) and Annual Ad Valorem Tax ...

TAVT Exceptions. Non-titled vehicles and trailers are exempt from TAVT – but are subject to annual ad valorem tax. New residents to Georgia pay TAVT at a rate of 3% (New Georgia Law effective July 1, 2019). If the vehicle is currently in the TAVT system, the family member can pay a reduced TAVT rate of .5% of the fair market value of the vehicle.

https://dor.georgia.gov/motor-vehicles/vehicle-taxes-title-ad-valorem-tax-tavt-and-annual-ad-valorem-tax